The Internal Revenue Service (IRS) has issued a declaration of tax relief to those affected by the wildfires that began on August 8, 2023, in parts of Hawaii. Individuals and businesses affected have until February 15, 2024, to file returns and make required payments. Consideration is given to victims of the wildfire destruction in these areas of Hawaii.

In response to the damage caused by the Hawaii wildfire, FEMA has declared a disaster in Maui and Hawaii counties. As a result of this declaration, those who live or operate businesses in the affected areas are eligible for federal tax relief.

In response to a declared disaster, it has been made possible for those affected to postpone their filing and tax payment deadlines. An example is when deadlines falling between August 8, 2023, and February 15, 2024, can be extended with special permission from the IRS.

The Internal Revenue Service (IRS) has issued a grace period extending to February 15, 2024, for all affected individuals and businesses who need more time to file tax returns between January 1, 2021 and April 18, 2023. This stipulation includes 2022 individual income tax returns, with an original due date of October.

The February 15, 2024, deadline also applies to:

- Quarterly estimated tax payments, which are normally due on September 15, 2023, and January 16, 2024.

- Excise tax returns and quarterly payroll which are normally due on October 31, 2023, and January 31, 2024.

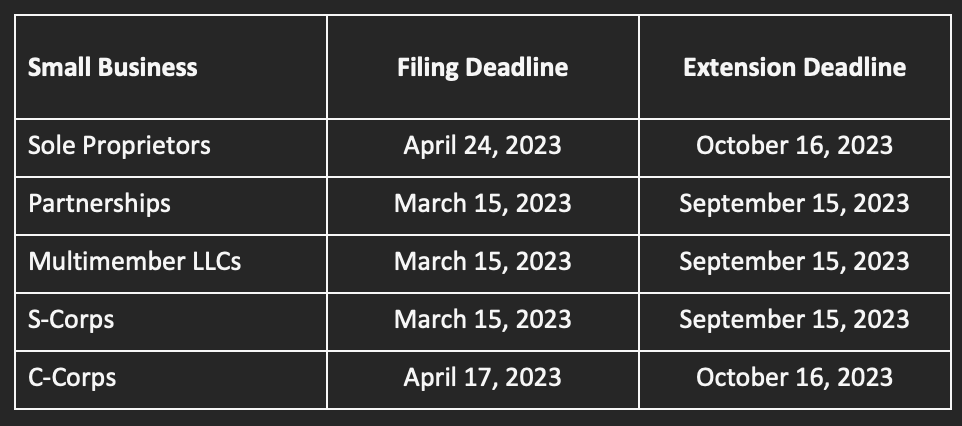

Businesses whose 2022 tax extension dates have elapsed or will soon elapse by September 15 (i.e., calendar-year partnerships and S corporations) and October 16 (calendar-year corporations) are eligible for the February 15, 2024 deadline for filing taxes.

On or after August 8, 2023, and before September 7, 2023, any late payroll or excise tax payments will receive abatement as long as the deposit is made by the said date.

When a taxpayer is subject to a late tax filing or late payment penalty notice from the IRS that had an original or extended due date during the postponement period, they should contact the number on the notification for the IRS to waive any charges.

Taxpayers affected by a covered disaster area can receive filing and payment relief from the IRS, provided they reside or have business in those areas. Those located outside of such regions should contact a dedicated PriorTax Tax Professional to benefit from this tax relief.

Who are Affected Taxpayers from Hawaii Wildfire?

Individuals and businesses affected by the covered disaster area, including tax-exempt organizations, are eligible for postponement of time to file tax returns, pay taxes, and perform other time-sensitive acts. This also extends to those who do not physically reside within the area but whose records necessary to meet a deadline lie within it. Thus, they, too, are entitled to some form of relief.

All those providing and receiving help during times of tragedy have the right to compensation for any damages incurred as a result of the disaster. That is why anyone affiliated with an official government or charitable organization assisting people affected by a disaster area is eligible for relief.

Taxpayers affected by the August 8, 2023 date will receive some relief from the Internal Revenue Service (IRS), as they can now file all relevant tax documents until February 15, 2024. This includes individual and corporate income tax returns, partnership and S Corporation returns, estate/gift/generation-skipping transfer taxes, annual information for tax-exempt organizations, and employment/excise taxes with either an original or extended due date up through February 15 of this year.

Taxpayers with estimated tax payments due between August 8, 2023, and February 15, 2024, now have an extension until February 15, 2024, to make those payments without facing any penalties for late payment. Those estimates must be paid before the end of that period to avoid penalty charges.

Declaring Casualty Losses from Hawaii Wildfire

For individuals impacted by a federally declared disaster, the option to declare casualty losses on their federal tax return for either the year of the occurrence or the previous year is available. Taxpayers who have selected this option and are reporting these losses on their 2022 returns have extended time until October 15, 2024, to make that choice.

Hawaii Wildfires have caused some taxpayers to seek out the disaster loss on their tax return. Make sure to state “Hawaii Wildfire” and the FEMA disaster declaration number, DR-4724-HI, at the top of your form. A PriorTax Tax Professional can assist individuals through this process from start to finish.

Other Possible Tax Reliefs

Taxpayers affected by disasters may find financial aid within their retirement plans or IRAs. For example, they could qualify for a special disaster distribution to spread the income over three years and avoid the extra 10% early distribution tax.

Those who pay taxes could qualify for a hardship withdrawal in certain instances. Every plan or IRA has separate rules and guidelines that must be adhered to by its participants.

The IRS may provide additional disaster relief in the future.

Taxpayers dealing with the repercussions of a disaster that the IRS has contacted in regard to a collection or examination should make their situation clear to the agency so that they can be given appropriate consideration.