When will you get your 2023 tax refund? Here’s our annual chart with our best estimates. Keep in mind that the answer is never exact, but we can make some educated guesses based on a few factors.

Now is also an excellent time to begin applying your year-end tax filing strategies that can lower your tax bill with tax credits or increase your refund with tax deductions. So whether you’re planning for next year or want to lower your bill this year, these strategies can help you out.

Have you had any significant changes in your life this year, like a new job, getting married or divorced, having a baby, retiring, buying a house, or changing investments? These types of things can have a significant impact on your taxes. So it’s a good idea to reach out to PriorTax Tax Professional sooner rather than later. Our dedicated tax professionals can make sure you are taking full advantage of all the tax deductions and tax credits you’re entitled to for maximum tax refund.

Are you wondering whether the 2023 tax filing season is going to be normal? While it’s impossible to say for certain, it’s likely to be closer to normal than it has been since 2019. That was the last tax filing season before COVID-19 caused widespread office closures, even at the IRS. As a result, the 2020 tax filing deadline was delayed by several months.

Don’t worry, the vast majority of taxpayers won’t have any issues come tax season. Just to be clear, the weeks leading up to April 18 2023 is when Americans file their taxes for the income they received during the 2022 calendar year. Alternatively, you can file for an extension, giving you an extra six months to sort everything out.

April 18, 2023 is the Tax Deadline!

What is the reason for the 2023 tax deadline being on April 18 instead of the 15th? The standard deadline of April 15 falls on a Saturday, so when this happens, the tax filing deadline to the next business day. However, in 2023 this Monday happens to be Emancipation Day.

The tax filing deadline to file your federal income tax return (Form 1040) is Tuesday, a state holiday Patriot’s Day in Maine and Massachusetts. Most states usually follow the same calendar for state income tax returns. Depending on when you file your taxes, you may receive your tax refund payment within 2-3 weeks.

When to File Your Tax Returns and Expect your 2023 Tax Refund?

It’s that time of year again the tax filing season is around the corner. It is time to think about maximizing your tax refund!

For most people, tax season starts in late January or early February. However, this year may be different due to recent changes in tax law. So it’s important to stay up-to-date on any new developments.

Generally speaking, early filers who are due a refund can expect to see their money sometime in mid-to late February. However, those who claim certain credits like Earned Income Tax Credit or Child Tax Credit may have to wait a bit longer for their refunds – about one month.

Last year was impacted significantly by Covid-19, which caused both deadlines and procedures to change.

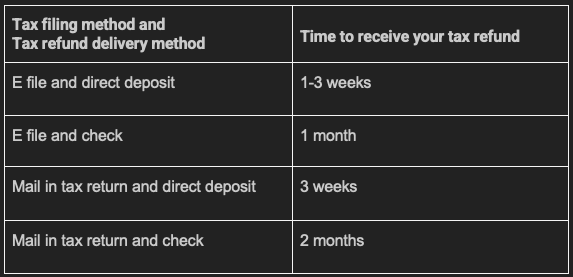

According to our projections, this is when you can expect to receive your income tax refund based on when you file your return. Keep in mind that this timeline is an estimate and may change depending on future events.

You can check on the tax filing status of your tax refund using the “Where’s My Refund” tracker from the IRS website or with your assigned PriorTax Tax Professionals. Just enter some basic information about yourself, and we’ll update you on where things stand.

It’s always a good idea to get your tax return in as soon as possible – and Efiling is the quickest, easiest way to do it. In general, you can expect to receive your refund via direct deposit within 2 weeks – although, during the busiest times of tax season (late March), it may take a bit longer. So gather up all your documents such as W2s, 1099s, mortgage, and student loan interest statements, etc.

There are a few important factors that can affect when you might get your 2023 tax refund, these include:

- How early you file

- Whether you’re claiming certain credits (especially EITC and CTC)

- Whether your return is e-filed or sent by mail

- Whether you have existing debts to the federal government

The IRS will delay processing by 2-3 weeks for income tax returns that claim the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC), so they can verify that taxpayers qualify for the credits.

Keep in mind that this is just an estimate of when you can expect your refund – it’s not exact, since every taxpayer has different returns and situations. Also note that the first column is when the IRS accepts your return, which can be 2-3 days after you submit it electronically. Mailing in a tax return can result in extra delay at the beginning of the process since the IRS will need to manually enter it into their system. But don’t worry – we’ll keep this page updated in case the IRS changes tax season this year.