Here’s how to get caught up on your late 2008 taxes.

If you forgot to file your 2008 tax return, you should do so as soon as possible. Sure, it’s been years since the tax filing deadline for that year, but you could and should still get caught up.

Here are two important reasons why:

- The IRS has up to 10 years to collect

- Late fees increase by the day if you owe tax from that year (the longer you wait, the worse the situation) The failure-to-pay penalty keeps accumulating every month your tax goes unpaid.

And an even better one:

- Uncle Sam is knocking at the door.

Before you get started, there’s something you must know. Unfortunately, you won’t be able to e-file your 2008 taxes. In fact, the IRS shuts down the e-file system at the end of each tax season and that one was, well, a long time ago.

If I can’t e-file then how do I file?

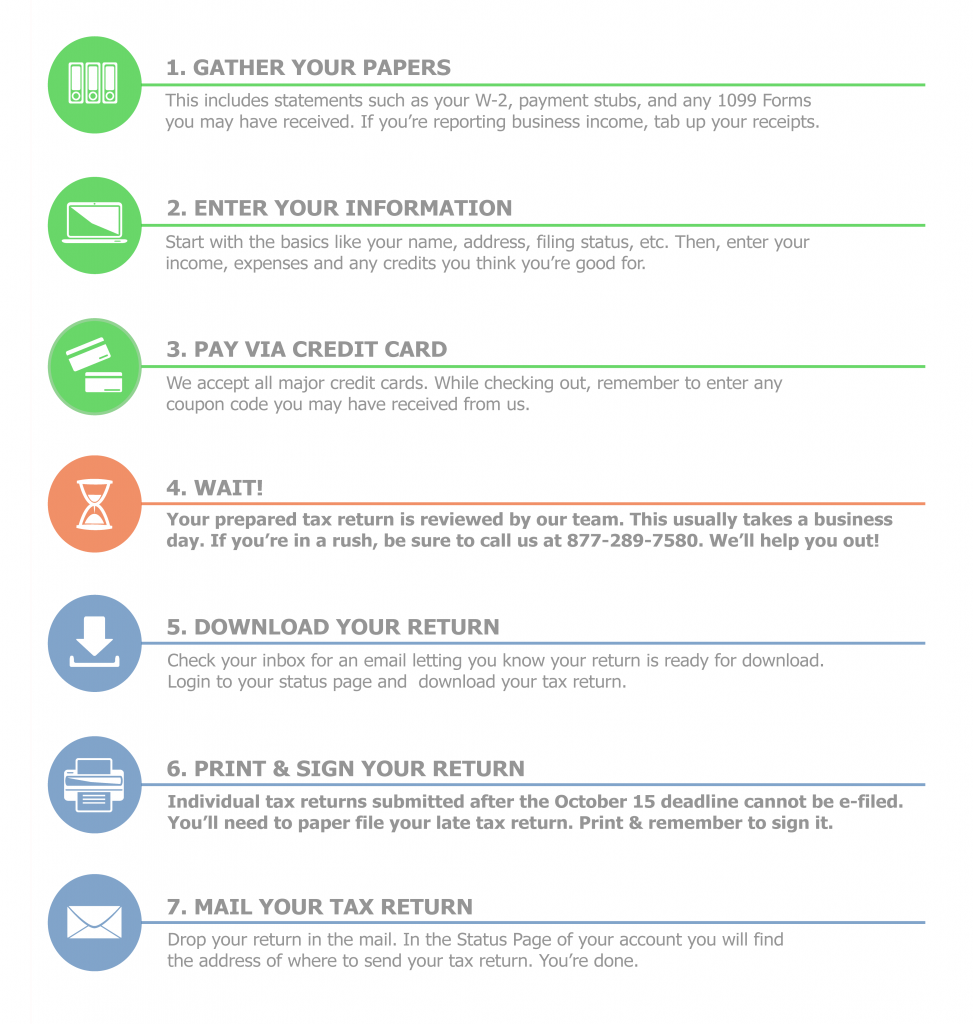

With e-filing unavailable, it means that you must paper-file your return. This means after you’ve prepared your tax return and we’ve reviewed it, you’ll need to download, print, and sign it before hopping over to the post office to mail it to the IRS or state.

However, if you’re suddenly in a hurry to get that 2008 return out, you want to allow for some time ahead.

Follow these 7 Simple Steps

Here’s a convenient recap of how it works:

What if I can’t locate my income statements?

If you can’t contact your past employer, you will need to request a Wage and Income Transcript from the IRS. You can do this online or by filling out Form 4506-T and mailing it to the IRS.

Start on your 2008 taxes today!

To prepare your 2008 tax return, create an account on PriorTax and enter your 2008 tax information. If you need help along the way, the PriorTax support team is available by phone, chat, and email.

Don’t put off filing any longer. Get it out of the way today.

I am interested in obtaining your services for filing back taxes 2008- present. My problem is in 2007 I filed taxes and the IRS kept my refund because they claimed I owed taxes for a back year (1991) I did not file a tax return, which they completed a return and estimated I owed them money.

Hi Barbara,

The first step would be to request a transcript of which returns were filed with the IRS. This tool is free to use and will let you know which years you have already filed for. Once you know which years are already accounted for, you can create an account with Priortax and begin entering your information for the years at hand. Seeing as you filed in 2007 and the IRS would not issue your refund, you should not be facing this issue again.

Can I get a tax refund on back taxes from 2008? I don’t owe any back taxes.

Hi Michael,

There is a three year statute of limitations put in place by the IRS for taxpayers to claim tax refunds. This means that you have three years from the original deadline to claim that year’s tax refund. The last date to claim a 2008 tax refund was April of 2012.

Hello there…ok i have a serious problem i file all my taxes but they say i didnt file my state taxes for 2007 08 and 2011 and 13. So my question is how do i file my states taxes for those years.

You can prepare your prior year state tax return at . It is important that you have your federal and state information for all of these years. If you do not have your federal information, you can request a transcript of your wages from the IRS or reach out to your past employers for your income statements. You can you can contact your State department of revenue for your state amounts since IRS transcripts do not include state information. Once you have gathered all of your information, you can begin the data entry process.

Please reference this article for more information regarding filing your prior year state tax returns. How To File State Taxes Late