Do you want to know the date for when are taxes due in 2022?

Well, we have the answer for you! According to the IRS, taxes are due on Tuesday, April 18, 2023. So be sure to mark that date in your calendar!

As the end of the every fiscal year approaches, many Americans begin to feel the pressure of taxes. For some, April 15 is a day of dread as they scramble to pull together all the necessary paperwork and documentation. Others look forward to receiving their refund check from the government.

No matter which camp you fall into, it is important to be aware of the latest changes to the taxation system. This year, for example, due to Emancipation Day being recognized as a holiday in Washington, D.C., taxes will be due on Tuesday, April 17.

The IRS typically starts accepting returns in late January, giving taxpayers nearly three months to get their affairs in order. However, victims of federally declared disasters may have an extended filing deadline.

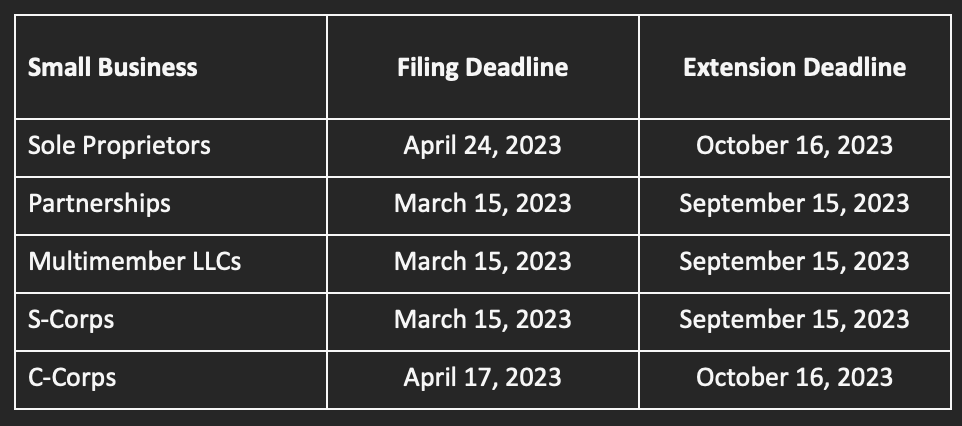

It’s important to be aware of the various tax deadlines that apply to you, such as the federal deadline, your individual state deadline, and the late filing deadline. Here, we’ve listed the major ones for the tax year 2022 (taxes filed in 2023).

When is the federal tax filing deadline and taxes due for 2022 Tax Return?

The deadline for federal tax returns and payments is April 18, 2023.

What are some other important dates for 2023 filing taxes?

The IRS has set the following deadlines for the upcoming tax seasons:

- January 2023 – IRS begins accepting returns

- February 21, 2023 – Fourth quarter estimated payments due for the tax year 2022

- February 1, 2023 – Employers must mail W-2 forms

- April 18, 2023 – Tax Day/federal returns and payments due, final day for 401k contributions, the final day to file an extension

What is the 2023 tax filing deadline for my state?

The due date for filing and paying state taxes varies by state. You can check your state’s Department of Revenue for the most up-to-date information.

As an independent contractor, consultant, or self-employed individual, it’s important to be aware of the various deadlines for filing your taxes. For example, the last quarterly estimate deadline for work completed during Q4 of 2022 is February 18, 2023. However, if this is your first time reporting an estimate, you may have some additional questions. In that case, check out more information about quarterly estimate taxes here.

We know it takes a lot of work to manage your calendar. That’s why PriorTax reminds you when quarterly estimates are due. Get started today!

When is the deadline to file a federal tax return extension in 2023?

The tax filing deadline to file a 2022 federal tax return extension is fast approaching! You must file a tax extension by April 18, 2023, to avoid penalties. Keep in mind that a 2023 tax extension only gives you more time to submit your tax return, not to pay your taxes. So make sure you have all your ducks in a row before the April 18 tax deadline!

Will the IRS extend the 2023 tax filing deadline for 2022 returns?

As we approach the end of the tax year, many people are wondering whether the IRS deadline for filing returns might be extended. Unfortunately, it’s not likely. The IRS typically only extends deadlines in the case of unexpected events, like natural disasters. The deadline is on track to be April 18, 2023.

When do I have to file an amended tax return for the 2022 tax year?

It’s important to know the deadline for filing an amended return, three years from the original due date. For example, the deadline for a return filed in 2023 would be April 18, 2026. After that, you would only need to file an amended tax return only if changes needed to be made, and you can’t amend a return until the IRS has accepted it.

How do I file online my 2023 taxes before the tax filing deadline?

Filing your taxes doesn’t have to be a chore. Let PriorTax take care of everything for you. We’ll tailor the filing process to your specific needs and make sure everything is done before the deadline. Plus, our support team is always here to help you out should you need it. So get started today and make tax season a breeze.