Guide to Tax Form and Tax Tables for 2019 Tax Refund and Late Tax Filing

When filing 2019 Federal Tax Return, there are two main types of paperwork from the IRS that you will find helpful: their 2019 Tax Tables and their 2019 Tax Forms. These are published each year by the IRS, and copies of all of them can be found on their website.

These documents can feel like a lot of complicated paperwork and additional pressure in addition to your own financial paperwork, especially when filing your back taxes. However, if you needed to file a return for the 2019 tax year but haven’t yet. It is a good idea to get on top of things and sort this out. So, let’s break things down so that you’re familiar with all the basics and ready to tackle your 2019 taxes.

What are tax tables for?

When we talk about tax tables, we’re referring to the tables created by the IRS that outline the total amount of tax that taxpayers owe. There are different tables and rates for different types of taxable income for both individuals and businesses.

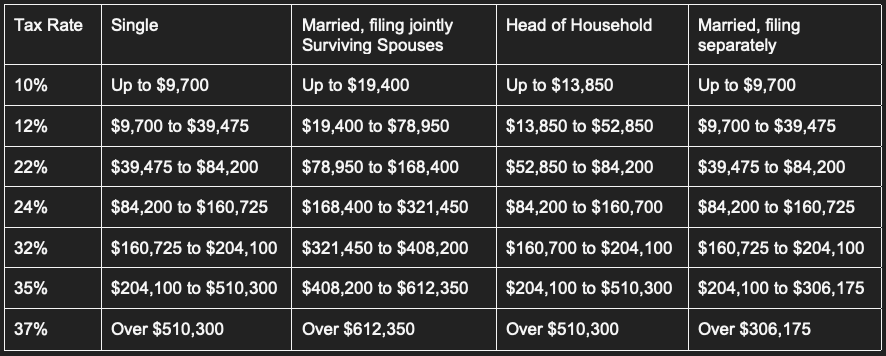

For individual income tax returns, the relevant tables are based on three things: your filing status, income range, and applicable tax rate or rates.

Tax tables can help you figure your tax based on your filing status and your taxable income amount.

This information can also help you to adjust your tax withholding from your paychecks – the amount of money your employer puts aside from your take – home pay each paycheck.

- If you’re withholding more than you need to, you will be able to get that amount back as a refund when you file your tax return. You could also consider adjusting your tax withholding to keep more of each paycheck throughout the year.

- If you’re not withholding enough and the amount underpaid works out to more than 10%, you may be liable for an underpayment penalty.

Are the 2019 Tax Tables different from tax tables for other years?

Yes. The 2019 Tax Tables will be different from those for tax years both before and after. Each year new tax tables are published, usually during the fourth financial quarter of the year.

This is because the income range brackets for the tables are indexed each year to take inflation into account. Since 2017, the government has used something called “the chained consumer price index”. It adjusts the tax brackets and other parts of tax law annually to account for changes to the cost of living in the country.

What information do you need to know when looking at the 2019 Tax Tables?

When reading the 2019 Tax Tables to prepare your federal income tax return, you should know your filing status and your taxable income.

Your taxable income is your adjusted gross income (all income you received in 2019 minus any adjustments that you qualify for). Of course, with any qualified business income deductions and either standardized or itemized deductions subtracted.

There are seven rate brackets for federal individual income tax, and where each bracket falls will depend on filing status. Everyone filing a federal personal income tax return will fall into one of five categories:

- Single

- Married, filing jointly

- Head of Household

- Married, filing separately

- Surviving Spouse/Widow(er)

Not confident which filing status applies to your circumstances? You can visit the IRS website and use their Interactive Tax Assistant to determine your status based on their guidelines.

Got your filing status and your taxable income to hand? You can now use that information to identify the applicable tax rates for your income and filing status.

It’s important to know that the tax system is progressive. This means that you pay the lowest tax rate (10%) on your income up to the first threshold. The next tax rate (12%) on your income between the first and second thresholds. The next tax rate (22%) on your income between the second and third thresholds, and so on.

Now that you know how the 2019 Tax Tables work let’s turn to the 2019 Tax Forms.

What 2019 Tax Forms do I need to file my 2019 Tax Return?

Form 1040 ‘U.S. Individual Income Tax Return’ is the main tax form that you will be filling out. This is the form used to add up your income and any and all deductions you are qualified for. If you are 65 years old or older, there is a variation known as Form 1040-SR U.S. Tax Return for Seniors is available. It is designed to be easier to read and fill out for seniors.

The other main category of 2019 Tax Forms to be aware of are the attachments to Form 1040, known as a group as Schedules. Again, requirements will depend on your circumstances. There are both numbered and lettered schedules that you may need to fill out. These documents are used to record things such as additional income and compensation, any deductions or credits you wish to claim. Any prior tax payments. You can use our free 2019 Tax Calculator to have a better sense of your return.

All 2019 Tax Forms are available to be downloaded from the IRS and come with instructions to follow that direct you to all the forms relevant to your situation that you need to fill out.

If you’re not confident making your way through the IRS forms on your own, using an online tax application is a great alternative. You can prepare your tax return with simple prompts to guide you through the process.

Are you ready to take the next step and get started filing your 2019 tax return? Then, visit our website and get in touch today. Our online tax application and experienced team of tax professionals can help you get caught up on your filing obligations today.