In the upcoming year of 2024 tax filing, prepare for a pleasant surprise as significant tax modifications are set to take effect. Brace yourself for potential financial gain, as your paycheck has the potential to grow generously if you find yourself in a lower tax bracket.

In a recent declaration, the IRS unveiled various significant modifications to the tax code. These alterations can potentially affect the amount of tax deducted from your earnings, causing potential implications for specific individuals.

In anticipation of the upcoming year, 2024 tax filing promises adjustments to the federal income tax brackets as well as an increase in the standard deduction. This significant modification is a direct response to the persistently soaring inflation that has kept the prices at an elevated level throughout the entirety of the current year.

Every year, the IRS implements modifications to the tax code as a means to accommodate inflation and prevent the occurrence of “tax bracket creep.” This phenomenon has the potential to push individuals into higher tax brackets despite the impact inflation has on their wages.

In the year 2024, it is possible that your chances of moving up to a higher tax bracket due to increased income could be mitigated by incorporating inflation into the tax code. It could result in a drop to a lower tax bracket. If your annual income remains steady from 2023 to 2024, you could see a slight increase in your take-home pay each payday.

How Changes in 2024 Tax Code May Affect Your Tax Refund

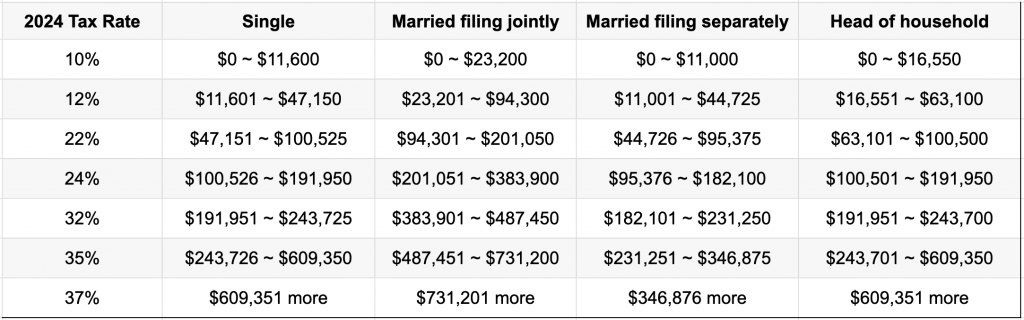

If the IRS increases federal income tax brackets, individuals may find themselves in a lower tax bracket compared to the previous year, especially if their income remains unchanged.

In 2023, let’s say you earned $47,000 and found yourself in the 22% tax bracket. However, fast forward to 2024; if your income stays the same at $47,000, you’ll now find yourself in the 12% bracket. This change in tax bracket implies that next year, you’ll be liable for a reduced amount of federal tax and will see a smaller deduction from your paycheck.

In the upcoming year of 2024, if your income surpasses that of 2023, the extent to which your earnings have grown will dictate your position. There exists the possibility that even with the recent alterations, you might still find yourself fitting into a lower tax bracket.

Regardless of the situation, it is crucial to acknowledge that in the current state of lingering inflation, the impact of high prices is being felt in various ways. Thus, even if one transitions into a lower tax bracket and receives a slightly larger paycheck in the upcoming year, inflation has already eroded the value of expenses for basic necessities such as housing, transportation, and groceries.

2024 New Income Tax Brackets

When it comes to calculating the amount of taxes you owe in a specific tax year, your federal income tax bracket plays a significant role. This bracket determines the percentage of your income that will be taxed, excluding any standard or itemized deductions.

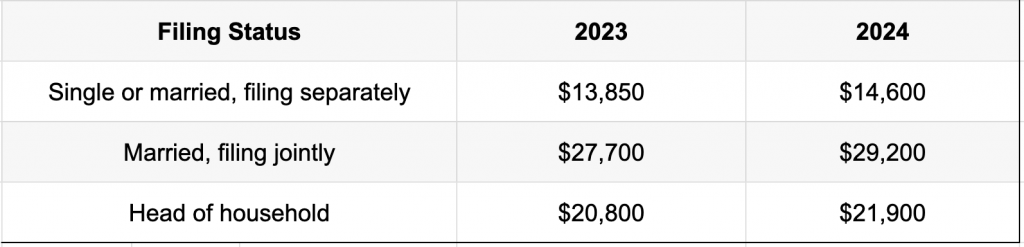

2024 New Standard Tax Deduction

In the upcoming year of 2024, a notable change has been made to the standard tax deduction for single filers. This adjustment has resulted in an increase of $750 compared to the previous year, bringing the tax deduction to a total of $14,600. Similarly, married individuals who file jointly will also experience a change in their standard deduction for the upcoming tax season.

When it comes to tax returns, many individuals opt for the standard deduction, which effectively lowers their taxable income. This is especially true for those who earn wages from a single employer as a W-2 employee, as it often allows them to maximize their tax refund. However, itemizing deductions may be a more suitable approach for self-employed individuals or those with particular deductions in mind.

Other Beneficent 2024 Tax Filing Updated

Starting next year, there will be a range of tax adjustments that have the potential to boost your monthly income. Those who are beneficiaries of Social Security will be pleased to know that a 3.2% cost-of-living adjustment is slated to take place in 2024. Furthermore, due to the fortuitous timing of New Year’s Day falling on a holiday, recipients can anticipate their first augmented SSI payment right around the end of December.

To assist taxpayers in maximizing their deductions and credits, the IRS unveiled many updates and enhancements for the upcoming year of 2024. Among these revisions are:

- An amplified cap for the Earned Income Tax Credit.

- Refinements to the gift tax exclusion.

- An expansion of the foreign earned income exclusion.

PriorTax free Dedicated Tax Professional will keep you up to date and walk you through navigating through 2024 tax filing for your maximum tax refund from start to finish.