How to file previous years taxes online?

You can file your previous years taxes and tax returns with PriorTax for up to three years after you are due. Simply sign in to your account or create a new one to get started. Then, click the “tax year” tab at the center of the top main menu on the home page. Select the year you want to create, then click Start Now. From there, you will input income and expense information for the year you are filing.

You can choose to e-file an electronic return for up to 3 prior years with PriorTax, or you will have to print out and mail a hard copy of your form. This is because the IRS does not support electronic filing of previous years returns. When you submit your previous years taxes using PriorTax, you will receive the proper forms and instructions for the particular year you are filing.

How many years can you e-file back previous years taxes electronically?

You can send your returns electronically for three years at PriorTax. That means that, in 2023, you could file a tax return for 2022 using PriorTax, and also be able to file your taxes from 2019, 2020, and 2021. Then, you can use paper filing for additional back taxes if needed.

You can usually find forms for earlier years on the IRS’s web site. However, the IRS generally does not examine returns more than six years late. In other words, your last six years worth of tax returns are generally the only ones that will be considered for audit. You can learn more about how to prepare a past-year return using PriorTax here.

Can I still get my previous years taxes to refund if I’m filing back prior taxes?

Yes, as long as you filed your return within three years after your original filing date. This deadline applies even for tax credits such as the Earned Income Tax Credit (EITC). Tax credits and deductions can greatly reduce your tax burden, so it is in your best interest to file during this three-year window to receive your earned tax credits and refund. If you have a previous-year return you are still due, you can start today with PriorTax, for free.

What if I don’t have receipts or records for previous years taxes?

Many employers maintain electronic records of employees W-2s, so it is possible you can obtain copies of your earnings information on the Internet. You may also see what forms your employer has filed with the IRS by asking for a tax transcript. You can download a copy of your prior years transcript from the IRS’s website. If you do, you can ask clients if they can supply records about what they paid you. And look at credit card statements or bank statements to see proof of expenses.

What else do you need to you when filing previous years taxes online?

If you want information from your previous years tax return, use Get Transcripts to request your return or bill transcript. In addition, if you have lost any of your tax documents from the past 10 years, you may request a copy from the IRS by filing form 4506-T, Requesting a Tax Return Transcript.

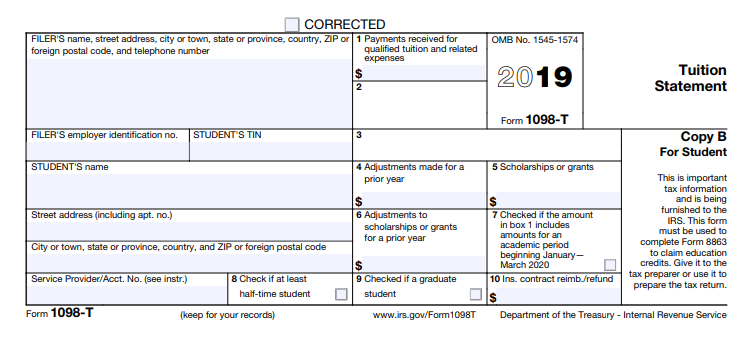

To file a tax return with the past returns, you will need your W-2s or 1099 forms that you received in those tax years to report your income.

Find that you made a mistake or forgot to include an income, a deduction, or another credit on your original return. You will have to file Form IL-1040-X, an amended individual income tax return. If you want to file your IL-1040 via MyTax Illinois, you must use your account to do so. Suppose you are self-employed and are not filing federal income taxes. In that case, any self-employment income you make is not reported to Social Security, and you will not get credit for Social Security retirement or disability benefits.

For example, Maine Revenue Service is available for filing an individual income tax return (Form 1040ME), including a credit to help pay property taxes like in Maine. This is the self-service option, purchasing tax preparation software, either at a retail store or online, preparing your return, and pressing submit for electronic filing. You may use a tax preparer, software approved by the state of Oregon, or free electronic filing services.

See if you qualify for filing previous years taxes with PriorTax

If you have used PriorTax in the past, you already know how to prepare and file your taxes online. The IRS Free File program can give you online tax software from a number of tax prep companies, including PriorTax.

If you do not qualify for online filing options, you can still electronically file your returns using PriorTax. You can also e-file using approved commercially available software programs or have an authorized tax professional prepare and file your return. If you had a tax professional prepare your return, you likely authorized that person to e-file for you.

Be sure the e-filing supports the forms you wish to file. Please be sure that the company providing the software supports all the forms and schedules you will need to electronically file your individual income tax return.

Under this arrangement, taxpayers may file federal income tax returns. Taxpayers may e-file either through their own computer or a tax preparer, an approved electronic return originator (ERO). While many taxpayers still mail their returns, e-filing, typically using an online tax preparation service, is becoming increasingly popular. As a result, the IRS anticipates that this year, the number of individuals efile for taxes will increase to record levels.

To better verify taxpayer identities and to help detect refund scams, we are now asking for identification information to ensure individuals tax returns.

If you are due a refund due to a tax lien or estimated tax, you have until the 3 years after your due date for filing the return to claim the refund. If you cannot pay all the taxes due by the due date, just file your return and pay what you can. If you missed filing a return in 2021 to claim the missed stimulus payments – just the stimulus payments checks – you will need to re-file taxes, which cannot efile electronically after Oct. 15, 2022.

File any taxes you are owed, whether you can make the payment or not. If you cannot fulfill your filing requirements, you are not required to file any returns from prior years. However, if you filed your return solely for that tax, you might choose to file Schedule H on its own.

Within 24 hours of your filing, the IRS will mail the proof of receipt to the software company you used. Once completed, the Federal and State returns are signed using either the Federal PIN number (or Form EF in Oregon). Filing with PriorTax to efile the previous years taxes returns sends a confirmation message saying the Tax Office received and accepted your return.

Prepare and efile your Federal and State returns electronically with PriorTax before tax day, so you will not have to do the difficult work of calculating taxes and mailing the information through the mail. During any given current tax season or calendar year, an on-time return will be prepared and efile electronically for the prior calendar year.