Filing prior year taxes may seem like a challenge but we have the perfect late tax solution right here online!

Getting ready to catch up on some taxes you forgot to file? You may think that you have to hunt down late tax forms or tax tables. Well, you don’t.

In fact, PriorTax offers online tax preparation services for tax returns going back to tax year 2005. No forms needed, ever. You can even use our prior year tax calculator to see if you have a refund coming your way from 2016 or 2017.

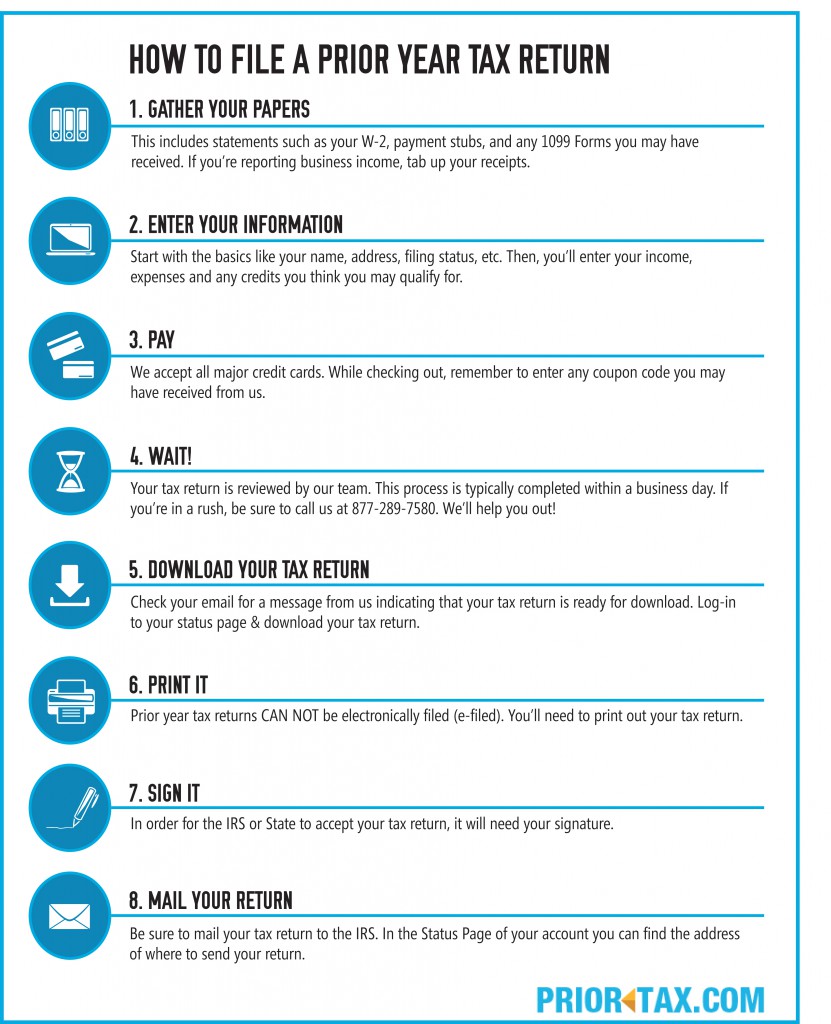

Before you start you need to keep this prior tax filing fact in mind: you won’t be able to e-file prior year taxes online. The IRS only offers e-file services to current year tax returns. When the tax season ends, e-file ends. Period.

So, what does that mean for you? Not having the option to e-file means that after you prepare your tax return and we review it, you’ll need to download, print and sign it before mailing it to the IRS by snail mail.

Here’s how it works in eight easy steps:

(Save this image to your computer – we’ve created it just for you!)

(Save this image to your computer – we’ve created it just for you!)

Start Your Prior Year Tax Return Online Today!

You won’t want to put off filing your prior year tax return much longer. IRS late fees increase as time passes. Waiting to file your tax return means that you’ll end up with a larger tax bill later on if you owe. You can save money if you do it today!

Just create an account to get started.

If you have questions while entering your tax information, our phenomenal tax support team is available via phone, chat and email support.

Need to go back to 2002 to file ….. is that possible?

Hello Robert,

You can still file a 2002 tax return. However, it is too late to e-file it and/or to claim a refund. You will need to prepare your information with the documents located on the IRS website and mail it to the address listed according to the instructions on your form.