Unlike the average American who only has to worry about tax deadlines once a year, business owners have a constant burden of filing tax forms regularly. Whether quarterly income taxes or keeping up with payroll taxes, there are always business tax deadlines to meet and obligations to fulfill.

In the upcoming year of 2024, small businesses will face a variety of important business tax deadlines that require their attention. To ensure a smooth process, it is recommended for small business owners to collaborate with a financial advisor who specializes in tax automation solutions.

Small Business Estimated Tax Deadlines

For anyone generating income through self-employment or freelancing, the responsibility of tax filing estimated income taxes is paramount. Often referred to as “quarterlies,” these tax filings are lodged approximately every quarter.

There are multiple reasons why the IRS mandates this. Its primary motive is to maintain a consistent flow of income for the agency. By implementing estimated taxes, the IRS ensures a steady influx of funds throughout the year instead of relying solely on a single annual collection.

With quarterly payments, there is an increased likelihood for businesses and individuals to have readily available funds. It is common for small businesses to neglect setting aside enough money for taxes, causing difficulties for the IRS when collecting a lump sum at the end of the year.

The amount of income tax you owe is calculated based on your income since your previous estimated payment, which is typically made every three months.

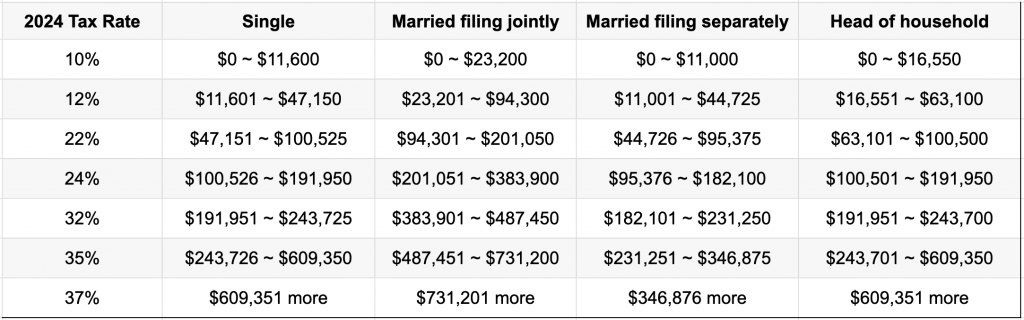

Instead of performing an exhaustive evaluation of your income, deductions, and expenses to determine your present tax bracket accurately, there is an alternative option. By applying the tax bracket from the previous year to the income earned in the last quarter, you can make an “estimated” tax payment. The IRS allows this simplified calculation method, making it possible to estimate your tax liability quickly and conveniently.

In 2024, you must prepare the quarterly tax filing on these dates:

- Q1, Jan. – Mar.: Due Apr. 15, 2024

- Q2, Apr. – May: Due June 17, 2024

- Q3, June – Aug.: Due Sept. 16, 2024

- Q4, Sep. – Dec.: Due Jan. 15, 2025

Small Business Income Tax Deadlines

Similar to people, companies are also required to submit their income tax returns annually. The specific due dates for filing these taxes vary depending on your business type. However, adhering to the business tax deadlines for submitting your taxes or applying for an extension is crucial.

- Partnerships, LLCs and S Corporations Using A Calendar Year: Due Mar. 15, 2024

- C Corporations and Sole Proprietors Using A Calendar Year: Due Apr. 15, 2024

- The IRS has scheduled Tax Day for Monday, Apr. 15, 2024.

Please be aware that corporations utilizing a fiscal year system are exempt from these time constraints. If you employ fiscal year accounting, you must submit your tax returns by the 15th day of April following the conclusion of your fiscal year, taking into account any potential holidays or weekends.

There are two important rules to remember regarding tax filing deadlines the IRS sets. Firstly, if you choose to file electronically, your submission will be considered on time as long as you manage to submit your forms by midnight in your local time zone on the day it is due. Secondly, if you opt for hard copy submissions, your forms must be postmarked by the due date to be considered on time.

Small Business Tax Form Deadlines

To successfully run a business, it is essential to maintain regular communication with the IRS. This ensures that both your finances and the financial well-being of your employees are properly accounted for. Although we won’t delve into the exhaustive details of monthly payroll tax filings, it is important to consult the comprehensive tax calendar provided by the IRS for a thorough understanding of the process.

However, the important unique business tax deadlines you need to know are

- Employees Must Receive W-2 Tax Forms: Jan. 31, 2024

- Independent Contractors Must Receive 1099 Tax Forms: Jan. 31, 2024

- Switch Business Election to S-Corporation for 2024 Taxes: Mar. 15, 2024

- File Business Taxes After An Extension, Partnerships, LLCs, and S Corporations Using A Calendar Year: Sept. 15, 2024

- File Business Taxes After An Extension, C Corporations and Sole Proprietors Using A Calendar Year: Oct. 15, 2024

It is important to keep in mind a few key factors. Initially, it is crucial to note that the business tax deadline for employed or contracted individuals differs from the majority of deadlines imposed by the IRS. In this situation, the documents must be obtained by Jan. 31, whether in electronic format or as a physical copy.

To begin with, although a tax extension provides an additional half a year to complete your necessary documentation, it remains essential to submit an estimated tax payment either in March or April (depending on the specifics of your organization). Pay an estimated amount considerably lower than your final tax liability to avoid the IRS imposing penalties for underpayment.

Small Business Payroll Tax Deadlines

When running a business that employs people, one responsibility that cannot be overlooked is managing payroll tax filings and payments. You must ensure that your employees’ payroll taxes and income tax withholdings are paid promptly and regularly. The frequency of these payments, whether on a monthly or biweekly basis, will depend on the specific nature of your company.

Apart from fulfilling these obligations, it is imperative to submit a payroll tax form to the IRS consistently. Although a handful of tiny enterprises may accomplish this by submitting Form 944 along with their yearly reports, most businesses will be responsible for their payroll tax filings every quarter through the submission of Form 941.

If the documentation reveals any outstanding taxes that surpass the pre-existing deposits, the corresponding payments will become payable one month after the submission.

These business tax deadlines are:

- Q1, Jan. – Mar.: Filing Due Mar. 31, 2024; Payment Due Apr. 30, 2024

- Q2, Apr. – June: Filing Due June. 30, 2024; Payment Due July. 31, 2024

- Q3, July – Sept.: Filing Due Sept. 30, 2024; Payment Due Oct. 31, 2024

- Q4, Oct. – Dec.: Filing Due Dec. 31, 2024; Payment Due Jan. 31, 2025

Tips for Small Business Tax Fling

Navigating the small business world inevitably leads to numerous encounters with the IRS. Whether managing payroll taxes or staying on top of estimated quarterly payments, it’s crucial to remain vigilant about your small business tax deadlines to avoid potential penalties or fees.

If you cannot meet certain business tax deadlines, you may find yourself in a position to dismantle your business’s legal structure. To avoid this outcome, consider locating your dedicated tax professional from PriorTax who can effectively handle these business tax deadlines on your behalf.

Start your journey towards a stress-free tax season by finding the free dedicated Tax Professional to assist you with your business taxes and filing needs. From the very beginning to the very end, PriorTax is here to ensure you are matched with the ideal dedicated tax professional, completely free of charge. Reach out now, and let’s start making your tax experience a breeze.